Die Entsendung von Arbeitnehmern ist eine gängige Praxis in der Europäischen Union (EU), die es Unternehmen ermöglicht, ihre Mitarbeiter vorübergehend in ein anderes Mitgliedsland zu entsenden, während sie weiterhin dem Sozialsystem ihres Herkunftslandes angehören. In diesem Zusammenhang ist die A1-Bescheinigung ein zentrales Dokument. Was enthält sie? Wie kann man sie erhalten? Welche Herausforderungen ergeben sich für Arbeitgeber und entsandte Arbeitnehmer? All das erklären wir Ihnen in diesem Artikel.

Was ist die A1-Bescheinigung?

Ein Nachweis über den Sozialversicherungsschutz im Herkunftsland

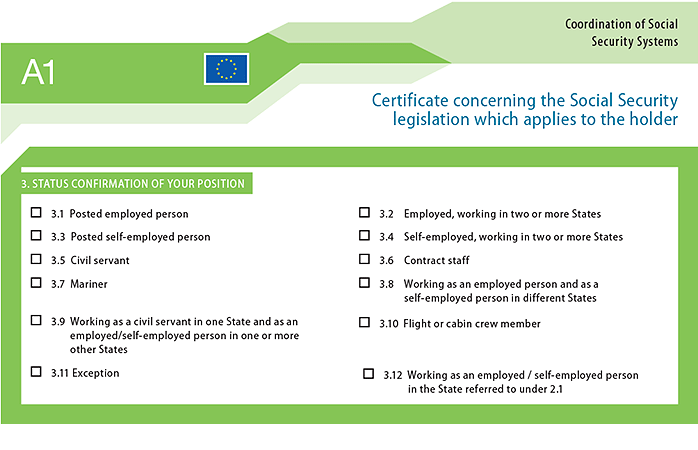

Die A1-Bescheinigung, früher als Formular E101 bekannt, ist ein von den zuständigen Behörden des Herkunftslandes ausgestelltes Zertifikat. Sie bestätigt, dass der entsandte Arbeitnehmer während der gesamten Dauer der Entsendung dem Sozialversicherungssystem seines Herkunftslandes angehört.

Dieses Dokument ist unerlässlich, um eine doppelte Sozialversicherungsbeitragspflicht zu vermeiden: Es stellt sicher, dass die Sozialabgaben nur in ein einziges System, das des Herkunftslandes, gezahlt werden, und dass dabei die Bedingungen des Arbeitsvertrags zwischen Arbeitgeber und Arbeitnehmer eingehalten werden.

Ein harmonisierter Rechtsrahmen

Die A1-Bescheinigung ist Teil der Verordnung (EG) Nr. 883/2004 über die Koordinierung der sozialen Sicherheitssysteme. Diese Verordnung zielt darauf ab, die freie Bewegung der Staatsangehörigen innerhalb der EU zu erleichtern und gleichzeitig ihre sozialen Rechte zu schützen.

Wer muss die A1-Bescheinigung beantragen?

Arbeitgeber im Rahmen einer Entsendung

Wenn ein Auftraggeber einen Arbeitnehmer in ein anderes EU-Land entsenden möchte, muss er das Formular A1 bei der zuständigen Stelle in seinem Land beantragen. In Deutschland erfolgt dieser Antrag bei der Bundesagentur für Arbeit oder genauer gesagt bei der Deutschen Rentenversicherung.

Selbstständige

Die A1-Bescheinigung ist nicht nur für Arbeitnehmer vorgesehen. Selbstständige, die vorübergehend in einem anderen Mitgliedstaat tätig sind, müssen diese ebenfalls beantragen, um nachzuweisen, dass sie weiterhin in ihr nationales Sozialversicherungssystem eingegliedert sind.

Wie füllt man die A1-Bescheinigung aus?

Die erforderlichen Schritte

- Vorbereitung der erforderlichen Informationen: – Die vollständigen Kontaktdaten des Arbeitgebers und des Arbeitnehmers; – Eine Beschreibung der ausgeübten beruflichen Tätigkeit; – Die Dauer der Entsendung; – Das Zielland.

- Die Anfrage einreichen: In Frankreich können Arbeitgeber diesen Schritt online über das spezielle Portal für Unternehmen durchführen.

- Das Formular erhalten: Nach der Bestätigung wird die A1-Bescheinigung ausgestellt, das jeder Arbeitnehmer während seiner gesamten Auslandstätigkeit aufbewahren muss.

Bearbeitungszeit

Es wird empfohlen, den Antrag mehrere Wochen vor Beginn der vorübergehenden Entsendung zu stellen. Die Bearbeitungszeiten variieren je nach Land, aber es ist unbedingt erforderlich, dass das Formular vor der Abreise des Arbeitnehmers vorliegt.

Fallstudie: Entsendung eines deutschen Arbeitnehmers nach Frankreich

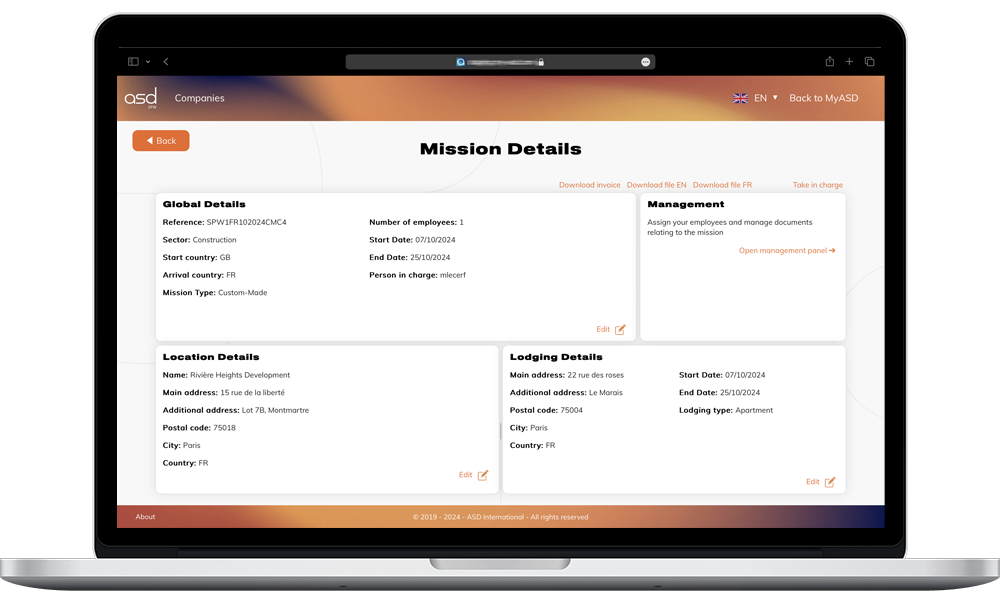

Nehmen wir das Beispiel eines ausländischen Unternehmens mit Sitz in Deutschland, das auf Ingenieurwesen spezialisiert ist und einen Techniker für ein Industriewartungsprojekt im Bauwesen für 4 Monate nach Frankreich entsenden möchte.

- Antrag auf A1-Bescheinigung : Das deutsche Unternehmen stellt einen Antrag bei den zuständigen Behörden in Deutschland und liefert die notwendigen Informationen über den Arbeitnehmer und die Mission in Frankreich.

- Kontrolle in Frankreich : Während der Mission führt die französische Arbeitsinspektion eine Kontrolle durch. Mit dem A1-Bescheinigung belegt das Unternehmen, dass die Sozialversicherungsbeiträge des Arbeitnehmers weiterhin in Deutschland gezahlt werden, gemäß der Richtlinie über die Entsendung von Arbeitnehmern.

- Ende der Entsendung : Am Ende der Mission informiert das Unternehmen die deutschen Behörden, dass der Techniker zurückgekehrt ist, und schließt somit den Prozess ab.

Ohne die A1-Bescheinigung hätte das Unternehmen Sozialabgaben in Frankreich zahlen müssen, was zusätzliche Kosten und administrative Komplikationen verursacht hätte.

Was sind die Rechte und Pflichten der Parteien?

Für die Arbeitgeber

- Die lokalen Vorschriften einhalten : Das Arbeitsgesetz verpflichtet ausländische Arbeitgeber, gleiche Arbeitsbedingungen für die in Frankreich entsandten Arbeitnehmer zu gewährleisten.

- Aufbewahrung der Nachweise : Die A1-Bescheinigung und die Entsendemeldung müssen im Falle einer Kontrolle verfügbar sein.

Für die Arbeitnehmer

- Nachweis der Sozialversicherung : Jeder Arbeitnehmer muss im Falle einer Kontrolle durch die lokalen Behörden die A1-Bescheinigung vorlegen können.

- Zugang zur Gesundheitsversorgung : Mit diesem Dokument behält der ausländische Arbeitnehmer seine Rechte in der Sozialversicherung seines Herkunftslandes.

Was passiert im Falle des Fehlens der A1-Bescheinigung?

Risiken für den Arbeitgeber

Im Falle des Fehlens die A1-Bescheinigung könnte der Arbeitgeber gezwungen sein, Sozialversicherungsbeiträge im Gastland zu zahlen, was zu einer Doppelbesteuerung führen würde. Darüber hinaus könnte dies als ein Versuch von Betrug oder der Missachtung europäischer Vorschriften interpretiert werden.

Sanctions für den Arbeitnehmer

Der Arbeitnehmer könnte auch den Zugang zu bestimmten Sozialleistungen verlieren, insbesondere in Bezug auf Gesundheitsversorgung oder Familienleistungen.

Brexit und Auswirkungen auf die A1-Bescheinigung

Seit dem Brexit ist das Vereinigte Königreich nicht mehr Mitglied der Europäischen Union. Das Handels- und Kooperationsabkommen, das 2020 unterzeichnet wurde, sieht jedoch spezifische Bestimmungen für die Entsendung von Arbeitnehmern zwischen der EU und dem Vereinigten Königreich vor (auf Englisch). Für Dienstleistungen ermöglichen jedoch spezielle Vereinbarungen weiterhin die Verwendung eines ähnlichen Formulars.

Hauptunterschiede:

- Die A1-Bescheinigung bleibt für Entsendungen anwendbar, unterliegt jedoch besonderen Bedingungen.

- Arbeitgeber müssen sich über die geltenden bilateralen Regelungen informieren.

A1-Bescheinigung: Ein Werkzeug zur Gewährleistung einer reibungslosen Mobilität

Abschließend lässt sich sagen, dass die A1-Bescheinigung unerlässlich ist, um die rechtliche und administrative Konformität bei der Entsendung von Arbeitnehmern in die Europäische Union sicherzustellen. Für Arbeitgeber ist es ein unverzichtbarer Schritt, um ihre Verfahren abzusichern. Für Arbeitnehmer ist es eine Garantie für sozialen Schutz und die Kontinuität ihrer Rechte.

Antizipieren Sie Ihre Schritte, respektieren Sie die Fristen und bewahren Sie eine Kopie dieses wertvollen Dokuments während der gesamten Entsendung auf.

Wenn Sie weitere Informationen zu den Verfahren wünschen oder Unterstützung benötigen, steht Ihnen unser Team zur Verfügung, um Sie bei Ihren Entsendungsverpflichtungen zu unterstützen.

Formalien, die bei einer Entsendung nach Frankreich zu beachten sind

Neben der A1-Bescheinigung muss eine vorab SIPSI-Erklärung bei den französischen Behörden eingereicht werden. Dies dient der Verhinderung möglicher Missbräuche und dem Kampf gegen Betrug bei der Entsendung.

Arbeitgeber müssen auch einen Vertreter auf dem französischen Gebiet benennen, der als Empfangsmitglied fungiert, um die Einhaltung der Vorschriften des Arbeitsgesetzbuches zu gewährleisten.

Zum gleichen Thema: Abordnung von Arbeitnehmern im Straßenverkehrssektor in Frankreich: Welche Vorabformalitäten sind erforderlich? (auf Englisch)

Die Bedeutung der Einhaltung der administrativen Verpflichtungen, um Sanktionen zu vermeiden

Die Risiken im Zusammenhang mit der Nichtvorlage der A1-Bescheinigung

Die Nichteinhaltung der Verpflichtungen im Zusammenhang mit der Entsendung von Arbeitnehmern kann sowohl für den Arbeitgeber als auch für den entsandten Arbeitnehmer schwerwiegende Verwaltungs- und Geldstrafen nach sich ziehen. Wenn ein Unternehmen die Voranmeldung nicht einreicht oder die A1-Bescheinigung nicht vorlegt, kann es mit Bußgeldern von mehreren tausend Euro belegt werden.

Außerdem könnte der Arbeitgeber im Falle einer Kontrolle durch die Arbeitsaufsicht verpflichtet sein, Sozialabgaben in Frankreich zu zahlen, was unerwartete Kosten verursachen könnte. Je nach Schwere des Vorfalls können administrative Sanktionen verhängt werden, einschließlich Strafen für Betrug oder für die Nichteinhaltung der Richtlinie zur Entsendung von Arbeitnehmern. Diese Strafen können noch strenger ausfallen, wenn Unregelmäßigkeiten in Bezug auf die Arbeitsbedingungen der entsandten Arbeitnehmer in Frankreich festgestellt werden, insbesondere wenn diese nicht von der gleichen Arbeit gleich mit anderen französischen Arbeitnehmern im gleichen Sektor profitieren.

In Sektoren wie dem Bausektor, in denen Kontrollen häufig sind, ist es besonders wichtig, dass ausländische Arbeitgeber alle erforderlichen Dokumente vorlegen, um nachzuweisen, dass ihre Arbeiter durch das Sozialversicherungssystem ihres Herkunftslandes abgedeckt sind.

Zum gleichen Thema: Frankreich: Änderungen in der BTP-Karte (auf Ensglisch)

Darüber hinaus könnte die Nichteinhaltung dieser Verpflichtungen rechtliche Schritte nach sich ziehen, wenn ausländische Staatsangehörige in eine prekarisierte Situation geraten, in der sie keinen angemessenen Gesundheits- und Sicherheitsschutz haben. Selbstverständlich können solche Kontrollen auch in anderen Sektoren wie Handel und Industrie, Eventmanagement, Transport, Weinbau oder auch Zeitarbeit stattfinden.

Daher ist es von entscheidender Bedeutung, die mit der vorübergehenden Entsendung verbundenen Verwaltungsformalitäten, wie z. B. die Beantragung die A1-Bescheinigung, genau zu verstehen, um Komplikationen zu vermeiden und sicherzustellen, dass alle Entsendungsmeldungen fristgerecht eingereicht werden. Eine ordnungsgemäße Einhaltung der Formalitäten vermeidet nicht nur Sanktionen, sondern stärkt auch das Vertrauen und die Zusammenarbeit zwischen den EU-Ländern.

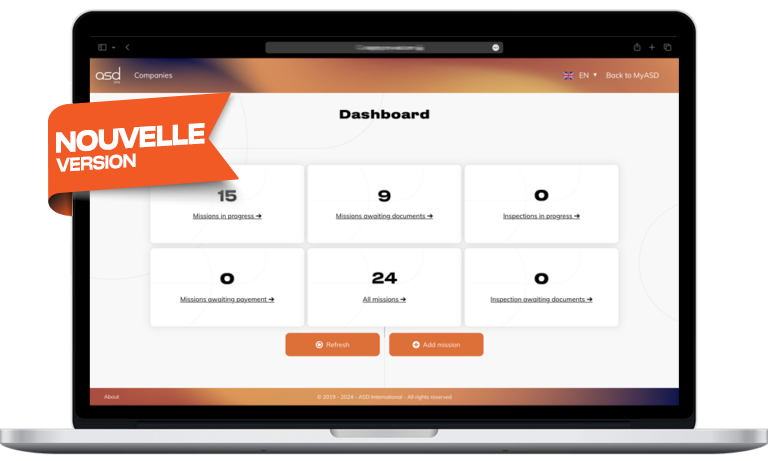

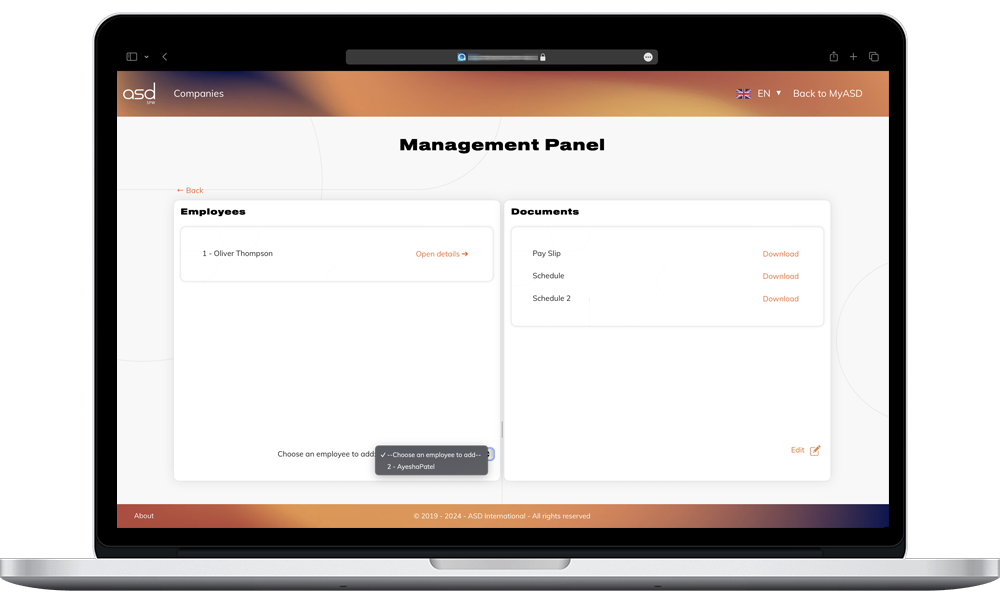

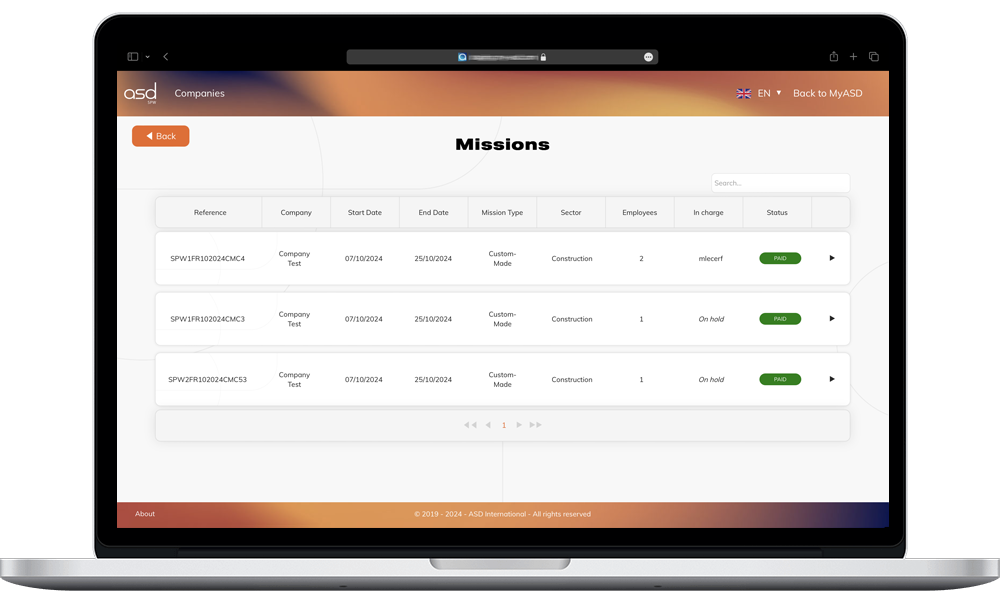

Erleichtern Sie sich Ihre Schritte mit ASD SPW

Die Formalitäten im Zusammenhang mit den Einsätzen Ihrer entsandten Arbeitnehmer zu verwalten, kann eine komplexe Aufgabe sein, insbesondere wenn es darum geht, alle administrativen und rechtlichen Verpflichtungen einzuhalten. Hier kommt ASD SPW ins Spiel, die vertrauenswürdige Plattform, die Ihre Formalitäten vereinfacht! Entsenden Sie Ihre Mitarbeiter, ASD SPW kümmert sich um den Rest! Die von der ASD Group, einem anerkannten Akteur in der Begleitung von Unternehmen auf internationaler Ebene, entwickelte Plattform bietet angepasste Lösungen für die Verwaltung Ihrer SIPSI-Voranmeldungen oder auch der BTP-Karten (für den Bausektor) und Ihrer Informationsdokumente sowie die Speicherung Ihrer A1-Bescheinigung. ASD SPW begleitet Sie bei jedem Schritt! Wir übernehmen nicht direkt das Ausfüllen Ihrer A1-Bescheinigungen. Unsere Rolle beschränkt sich darauf, Ihnen Informationen und Ressourcen zur Verfügung zu stellen, die Sie benötigen, um die Verpflichtungen und administrativen Anforderungen jedes Landes zu verstehen, aus dem Ihre entsandten Arbeitnehmer ausreisen.

Achtung : wir übernehmen nicht direkt das Ausfüllen Ihrer A1-Bescheinigungen. Unsere Rolle beschränkt sich darauf, Ihnen die notwendigen Informationen und Ressourcen zur Verfügung zu stellen, um die Verpflichtungen und administrativen Anforderungen jedes Herkunftslandes Ihrer entsandten Mitarbeiter zu verstehen.

Mit ihrem Fachwissen gewährleistet ASD Group eine schnelle und konforme Bearbeitung Ihrer Fälle und hilft Ihnen dabei, Fehler zu vermeiden, die zu Verwaltungsstrafen führen könnten. Als dedizierte Plattform ermöglicht es Ihnen ASD SPW, sich auf Ihr Kerngeschäft zu konzentrieren, während wir alle Formalitäten im Zusammenhang mit der vorübergehenden Entsendung Ihrer Mitarbeiter auf französisches Staatsgebiet übernehmen.

Um mehr über unsere Dienstleistungen zu erfahren und herauszufinden, wie wir Ihnen helfen können, kontaktieren Sie uns jetzt oder schauen Sie sich unsere FAQs an!

Haftungsausschluss: Die in diesem Artikel präsentierten Informationen sollen einen allgemeinen Überblick über die geltenden Vorschriften zur Entsendung von Arbeitnehmern nach Frankreich geben. Sie stellen in keinem Fall eine rechtliche, steuerliche oder administrative Beratung dar. Da die Vorschriften Änderungen unterliegen, empfehlen wir, uns zu kontaktieren, um eine Beratung zu erhalten, die an deine spezifische Situation angepasst ist. Wir übernehmen keine Haftung für Fehler, Auslassungen oder ungenaue Interpretationen der bereitgestellten Informationen.